Boat Loan: Finance a Boat & Boat Loan Calculator

Get your money on your terms – Receive funds in as little as 15 minutes.

Competitive rates and flexible terms will help you sail into your dream boat

With competitive rates and flexible repayment terms, we make it easy to get on the water. Plus, our online application process is quick and hassle-free, so you can get approved and on your way to cruising the open waters in no time. Choose Boat Loan by Loanz for all your boat financing needs.

Don’t let your credit score hold you back, let us help you reach financial success

BOAT LOAN CALCULATOR

Our Boat Loan Calculator is here to help! With just a few simple inputs, you can quickly and easily see what your monthly payment will be and how much you can afford to borrow.

Plans

We offer a variety of flexible payment plans, with duration options ranging from 12 to 60 months.

Rates

We have the most competitive interest rates, making them more attractive choice than typical payday loans.

Fees

Our loans have no upfront payment requirements and no penalties for paying off the loan ahead of schedule.

100% Online

With our 100% online process makes it is easy to get a quote anytime, anywhere. We are completely digital.

Hassle-free

Link your bank account to streamline the application process and allow us to quickly verify your eligibility for a loan.

Fast Access

Get approved in minutes for up to $15,000. Perfect for car or auto repairs, unexpected emergencies, or debt consolidation.

3 Easy Steps

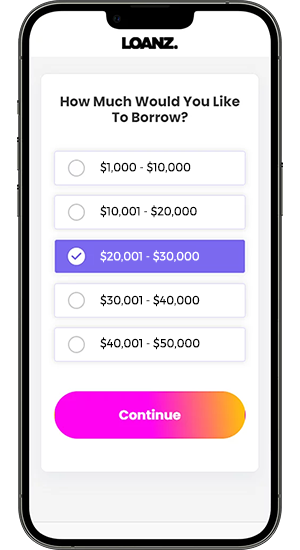

Apply Application

Our online application can be completed in just a few minutes & all of your information is protected

Get Approved

Once we receive all the necessary information, we will promptly process your application.

Quick Funding

Choose from options for receiving your funds. Each payment will be reported to credit agencies to improve your score.

What Customers Say About Us

Frequently Asked Questions

(FAQs)

What is a Boat loan?

A boat loan is a type of personal loan that is used to finance the purchase of a boat. It works in much the same way as a car loan or a mortgage, in that the borrower takes out a loan from a lender and agrees to make monthly payments until the loan is paid off.

Will the interest rate and payment for my loan remain constant throughout the loan period?

Yes, the interest rate and payment for your loan will stay the same for the duration of the loan.

How quickly will I receive my loan from you?

Our loan process is faster than many other companies in the industry. In some cases, you may receive the money in your bank account within 15 minutes of applying.

Why should I choose to take out a loan with your company?

We make the loan application process easy and convenient, with the option to apply online without the need to visit a physical location or speak with anyone. We also offer more flexible and accessible options compared to traditional banks.

What do I need to have in order to apply for a loan with you?

To use our service, you will need an internet connection, a phone, and access to online banking. If you do not have online banking, you can still apply by manually inputting your income information and providing additional documentation.

Are boat loan tax deductible?

If you have a boat loan, the interest you pay on that loan may be tax deductible. In order to qualify for this deduction, the boat must be considered a second home for tax purposes, which means it has features such as a bedroom, kitchen, and bathroom. In order to claim this deduction, you must also itemize your deductions when you file your taxes. It is always a good idea to consult with a tax advisor for personalized advice on your specific situation.