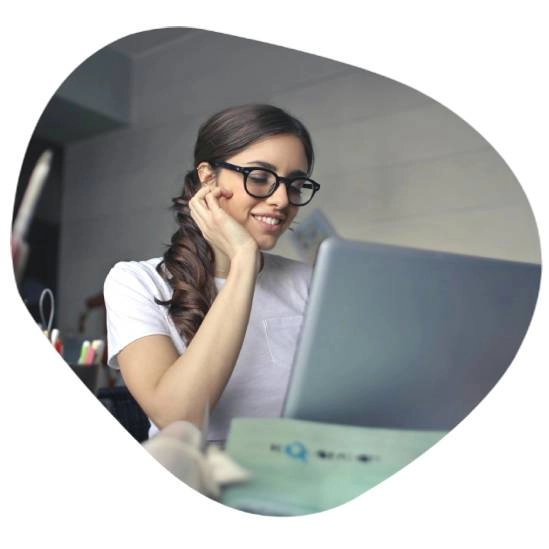

Student Loan in Houston, TX

Make Your Education Affordable

Investing in your education is one of the best ways to secure a successful future, but paying for school can be challenging. A Student Loan in Houston, TX can help you manage the costs of tuition, books, and living expenses, so you can focus on your studies. With flexible repayment terms and competitive interest rates, student loans can help make your education more affordable.